Living with Contagion

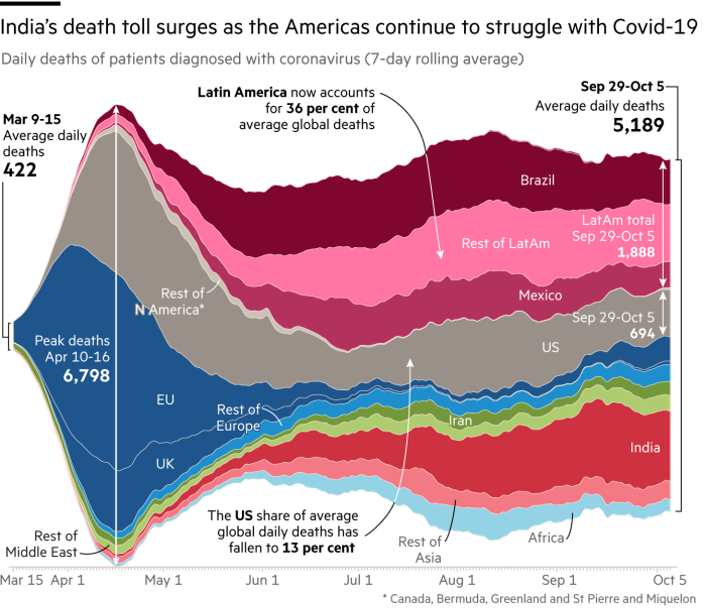

Figure 1 Still on the rampage Source: FT

President Trump’s behaviour may becoming increasingly bizarre but his exhortation to ‘live with the virus’ surely rings true right now, even if it is a bit rich coming from someone who has access to unrivalled medical facilities. The challenge of highly contagious pandemics- and epidemiologists are expecting them to occur more frequently- is that they render impossible any trade-off between public health and economic growth. If people believe they will fall ill, they will try to protect themselves and expect help and support as they do so. Most will try to work at home or in safe conditions elsewhere but not everyone can do that and far fewer, especially parents of school children, can avoid contact with others. Economic activity will surely continue but it will be constrained at the margin for as long as the pandemic persists. Accordingly, any national economy’s ability to live with contagion is dependent on effective public health, with three major elements:

Rapid drawing up and communication of a strategic response to outbreaks.

Competent implementation, including sufficient qualified staffing with protective equipment, test-and-tracing, social distancing, hospital capacity, efficacious medicines and other therapies..

Compliance with restrictive measures, preferably based on trust in both national and local authorities but by draconian enforcement if necessary

To be fair to those in charge, containing COVID-19 has not proved at all easy. It is especially contagious and prone to successive waves. It displays extreme variations in the severity of symptoms, combines harmfully with common co-morbidities (obesity, diabetes) and can cause unpredictable post-recovery respiratory, renal, coronary and neurological complications ‘long COVID’). Having said that, there has been globally an inspirational response from the medics in respect of palliative care while scientists and pharmaceutical companies are racing to develop safe monoclonal antibody serum antidotes as well as preventative vaccines.

Figure 2 OECD always looks on the bright side! Source: WSJ

Some governments were clearly prepared for something like COVID-19 and others able to contain it but it has to be said that most are still struggling to varying degrees in respect of all three elements. The following remarks on individual countries, however, should be viewed purely in an economic context (Figure 2):

The most effective public health response has come from China, Taiwan, Vietnam and South Korea, all of which had developed expertise in managing viral pandemics. As well as getting on top of the first wave of infections they are continuing to manage subsequent local outbreaks. Their economies were less badly affected in the first half of 2020 and they are on track to catch up on ground lost as soon as the next few months.

Thailand, New Zealand, Denmark, Norway, Finland and Germany were less prepared but acted quickly even at the cost of severe short-term economic pain. They are still having to juggle with lifting restrictions but their respective economies should return to net growth (Q4 2019 GDP levels) by late 2021/early 2022.

Japan, Hong Kong, Singapore and Australia had early success but their economic recovery has been held back by renewed local outbreaks. Net growth is unlikely before late 2022.

Italy was almost overwhelmed by the pandemic in the early months but clear communication and a strong community response from around the country has helped limit the damage to an already soft economy. Achieving net growth could, nevertheless, take as long as until 2025.

Sweden initially relied on its high quality health system and social solidarity to avoid extreme restrictions while hoping that something akin to herd immunity would develop but, faced with a relatively high death count, now appears to be resorting to measures similar to those in other countries. Net growth should be achieved by the end of 2022.

The UK, US, Spain, France, India, Iran, Canada, Mexico, Brazil, Peru, Malaysia and South Africa are suffering from their earlier and still continuing ineffective public health responses. Future growth is hard to forecast for such different economies but a crucial divergence may occur not just in respect of how much government support will have been provided (not much in the poorer countries but also in what form. Wrangling continues in the US but the support has mainly come in the form of benefits to individuals rather than subsidies to companies as in Europe. The latter seem to have worked well as temporary measures in Germany and the Nordic countries but, if carried on for too long, increase the risk of fraud and corporate ‘zombification’. In particular, the UK is faced with a quadruple whammy from its furlough subsidy scheme turning sour, the current second wave of the virus, continuing failure to introduce effective testing and tracing and Brexit dislocations (a 13th hour deal may now be the best case), and would do well to achieve net growth before the end of 2023.

Figure 3 Living with the virus will be tough for many

While the dates for a return to net growth in the various economies listed above may seem grim it is important to realise, as does the OECD and other brave forecasters, that they do not herald a global collapse (Figure 2) and certainly not one solely attributable to COVID-19, which is as much a catalyst as a cause. The fundamental problem is that the more developed is an economy the more it is dependent to keep on growing on the symbiotic relationship between Employment and Consumption. Despite the increasing numbers living past official retirement age, most people’s spending is funded by wages and not savings (Figure 3). Any reduction, even at the margin, of either Employment or Consumption will affect the other: faced with falling sales, businesses will start cutting back on staffing and investment while anyone unsure of their job will start to tighten their belts. The challenge is made greater by the reliance on debt by both businesses and consumers, not always for investment but sometimes merely to survive through difficult times (self-inflicted or otherwise). In fact, there has been a decades-long increase in debt and it is already possible to see that many borrowers are at or beyond their limit. Some companies, not just zombies on the life support of low interest rates and lender forbearance, are simply not going to pull through (Figure 4). After all, the rate of growth in the global economy, especially in the developed countries, was slowing before the pandemic broke. As far as 2020 is concerned that means contraction except in China, Taiwan and Vietnam but even they will need help from their trading partners to maintain momentum. Elsewhere, even though most consumers will survive somehow and new companies will eventually arise in whole new sectors, thereby creating new jobs, living with the virus will be tough for many of us.

Figure 4 COVID-19 kills businesses too!

The latest price movements suggest that global financial markets are already moving forward to broad sunlit post-COVID uplands. Certainly, they are notoriously indifferent to economic vicissitude, not to say human misery. However, there is some clear correlation between the performance of equities in China, Taiwan, South Korea, Denmark, Finland and New Zealand and effective public health policies. The same could be inferred of Japan and Germany with a negative correlation in the UK and much of the rest of Europe. Another factor that also embraces the US is the renewed surge in global liquidity since February, which seems to have acted as a kind of reassuring economic vaccine for many investors, including the new cohort of option traders. Of course, Fed and other central bank largesse had been flowing for much of the last 12 years with at best a patchy impact, which has challenged the equilibrium models that remain sacred to many economists. In fact, pushing the medical metaphor further, monetary easing looks increasingly palliative in keeping the global economy breathing but without ever eliminating the underlying symptoms. This could (should?) be troubling for investors but the COVID-19 crisis has revived and boosted an erstwhile economic medicine: Keynesian fiscal stimulus. The US government has been eagerly throwing money at the economy and another stimulus package is confidently expected, irrespective of the election result on November 3rd. Other governments are following suit as much as they can afford, which probably helps to explain the recent surge in equity markets in India and Australia. There can be no doubt that fiscal stimulus is not just politically necessary but also economically and socially but massive indiscriminate subsidies can only be palliative at best and then there is the awkward question of how it can be paid for. A real economic vaccine is needed as well as a medical one!

Meanwhile, more than 37 million cases and 1.1 million deaths have been reported so far and these may well be understated with many more to come in the Northern Hemisphere winter months. Those who are not, or have not been, ill are scared and angry, albeit for opposing reasons. We may be seeing some dramatic economic data bouncing back from unprecedented slumps earlier in the year but unless governments give priority to making public health more effective, the recovery will stall. Some governments are making more progress than others. How much progress will be revealed, not so much in the wildly swinging economic data in 2020 but rather in 2021 and 2022, during which time we really shall have to learn to live with the virus.

Figure 5 An economic vaccine or merely temporary palliative care?

This report is compiled from sources Argyll Europe Ltd (Argyll) believes to have been reliable but it may not be complete or accurate on any particular subject. All opinions, estimates and analyses are or were those of Argyll at the date of issue and are subject to change without notice. Accordingly, none of Argyll, any one or more of its directors, employees and or affiliates makes any representation or warranty on any subject discussed in the report: nor do they accept responsibility or liability for any claim, loss, damage, expense or cost arising from reliance upon its contents. Argyll considers that this report falls outside the scope of the Financial Services and Markets Act 2000.